How to Avoid Capital Gains Tax on Real Estate?

You bought a property, held onto it, maybe made some upgrades, and now it’s worth more than what you paid. Selling sounds great… until you hear the words: capital gains tax.

But here’s the good news: There are legal ways to reduce or avoid it. And if you plan ahead, you won’t be caught off guard when it’s time to sell.

Let’s break down what capital gains tax actually is, who it applies to, and how you can sidestep it smartly, especially if you’re a homeowner or real estate investor in Houston.

What Counts as a Capital Gain on Your Houston Home?

You bought your dream home in Houston, maybe in Midtown, Katy, or Pearland, a few years back. It’s gone up in value, you’re thinking of selling, and then someone says, “Careful, capital gains tax might hit you.”

So what exactly is that?

Capital gains is just a fancy way of saying this: if you sell your home for more than what you bought it for (plus improvements and fees), the IRS may want a cut of your profit. And while Texas doesn’t charge a state income tax, the federal government still does, and depending on your situation, that could be a small dip or a big dent.

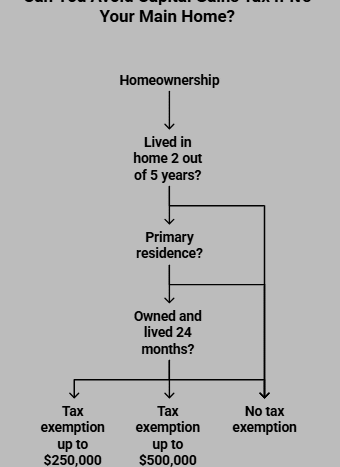

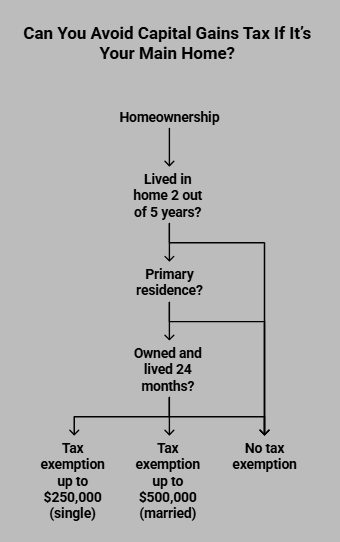

But: Can You Avoid Capital Gains Tax If It’s Your Main Home?

Yes, and this is one of the biggest perks of homeownership.

If you’ve lived in your home for at least 2 out of the last 5 years before selling it, you may be able to avoid taxes on up to $250,000 (single) or $500,000 (married filing jointly) of the profit.

The key? It must be your primary residence, and you must’ve both owned and lived in it for at least 24 months in that 5-year window. For many homeowners in Houston, especially those moving for a job or upsizing, this exemption can save serious money.

If you’re selling your home for the first time and are unsure how the process works, don’t navigate it alone. Reach out to a real estate agency that knows the Houston market and can guide you every step of the way.

What If You’re Selling a Rental or Investment Property?

Selling a rental or investment home in Houston? Unlike your primary residence, this type of sale usually triggers capital gains taxes. But there’s a smart workaround many investors use, the 1031 exchange.

Here’s what you need to know:

- Capital gains tax applies to most investment property sales unless you reinvest through a 1031 exchange.

- A 1031 exchange lets you defer taxes by reinvesting your proceeds into another “like-kind” investment property.

- You must act fast. Identify the new property within 45 days, and close on it within 180 days of selling the old one.

- The exchange must be handled by a Qualified Intermediary; you can’t touch the funds directly, or the tax break won’t apply.

Local example: Many investors sell in older Houston neighborhoods like Sharpstown and upgrade into higher-demand areas like Cypress, using a 1031 to keep all their capital working for them.

Do Renovations Help Reduce Your Capital Gains?

Yes, and this is where most sellers leave money on the table.

When you make major upgrades to your home, think kitchen renovations, new roofs, HVAC installations, these aren’t just expenses. They’re called capital improvements, and they increase your home’s cost basis.

That means when you sell, the IRS sees your “profit” as smaller, and your tax bill drops.

So if you’ve been upgrading your home over time, keep those receipts. Those details could lower your capital gains, especially if you’re selling after a few years of ownership in Houston’s housing market.

Does It Matter When You Sell?

Absolutely. The timing of your sale can affect how much tax you owe.

If you sell a property you’ve owned for less than a year, the gain is taxed as ordinary income, meaning it could fall into a high tax bracket.

Hold the property for more than a year? Now it’s a long-term capital gain, and the tax rate is lower: 0%, 15%, or 20%, depending on your total income. That difference can mean thousands saved, just by being strategic about when you sell.

Are There Any Other Smart Ways to Lower Capital Gains?

Yes, and some of them aren’t just for seasoned investors. Check out the ways below:

- Offset your gains with losses from stocks or other assets (this is called tax-loss harvesting).

- Gift the property to family in lower tax brackets, useful for estate planning or generational wealth.

- Look into opportunity zones for reinvestment, though these are more complex.

The point is, whether you’re selling your first condo in Montrose or moving up from a starter home in Alief, there’s always a strategy to reduce your tax impact, as long as you plan ahead.

Final Thoughts

Capital gains tax can feel like a surprise expense, but with the right strategy, it doesn’t have to hit hard. From exemptions to exchanges to smart timing, there are legal, effective ways to reduce what you owe or avoid it altogether.

At KV Properties, we don’t just help you buy and sell. We help you understand the bigger picture, including how each move impacts your long-term wealth.

Got a property you’re thinking of selling in Houston? Let’s make sure you do it smart. Get in touch with us, and we’ll walk you through your best next step, with your goals (and taxes) in mind.

Frequently Asked Questions

Is there a capital gains tax in Texas?

Texas doesn’t have a state capital gains tax; you only pay federal tax.

Can I avoid capital gains if I reinvest in another property in Houston?

Yes, but only through a 1031 exchange, and it applies to investment properties only.

How long do I need to live in a home to get the capital gains exemption?

At least 2 of the last 5 years, and it must have been your primary residence.

Do renovations count toward reducing my capital gains?

Yes. Improvements like kitchen remodels, new roofs, or HVAC systems add to your cost basis and reduce your taxable gain.

Can I do a 1031 exchange on my own?

No. The IRS requires a Qualified Intermediary to manage the transaction and hold the proceeds.

Karishma Naidu Vohra is a dedicated real estate agent renowned for her entrepreneurial spirit and commitment to excellence. After developing her skills in Los Angeles, she found her true passion in Houston, where she specializes in buying, renting, and selling properties.