Are Property Tax and Real Estate Tax the Same?

If you’ve recently bought a home in Houston or are planning to, you’ve probably seen the terms property tax and real estate tax thrown around like they’re the same thing. And honestly? Most people (even seasoned homeowners) use them interchangeably.

But are they actually the same?

Let’s break it down in a way that’s easy to understand, no jargon, just what you need to know as a Houston homeowner.

So… Are Property Tax and Real Estate Tax the Same?

In most cases, yes, they refer to the same thing.

“Property tax” is the term we hear more often, especially in Texas. But officially, the IRS and government agencies might call it “real estate tax.” Both refer to the annual tax you pay on your property’s assessed value, whether you live in it, rent it out, or keep it as an investment.

So if someone says you’re responsible for real estate taxes, yes, they’re talking about your regular property tax bill.

But there are a few subtle differences worth noting, especially when you factor in other types of property ownership.

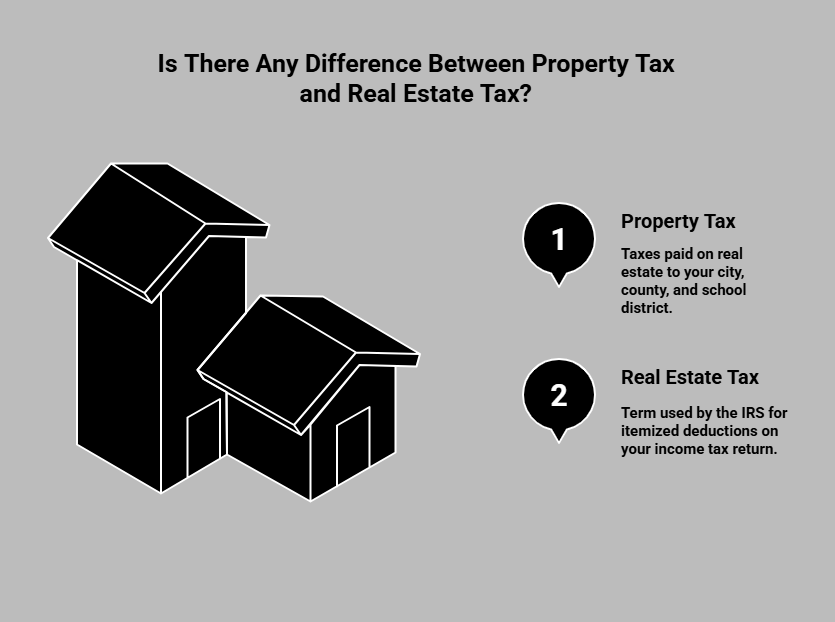

Is There Any Difference Between Property Tax and Real Estate Tax?

Technically, real estate tax is the term used by the IRS and government agencies to refer to taxes levied on land, luxurious property, and buildings. Property tax, on the other hand, is more of a general umbrella term.

In Texas, though, the two terms are often used to mean the exact same thing. You’ll see “property tax” on your local county tax bill. But when it comes to federal deductions, it’s referred to as “real estate tax.”

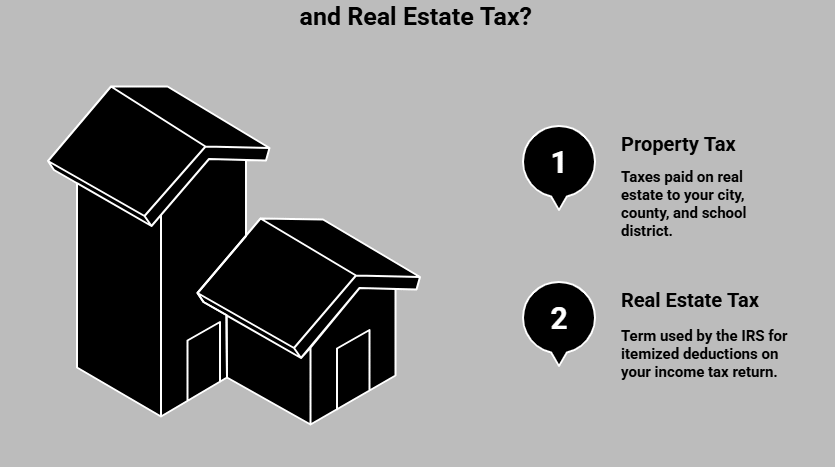

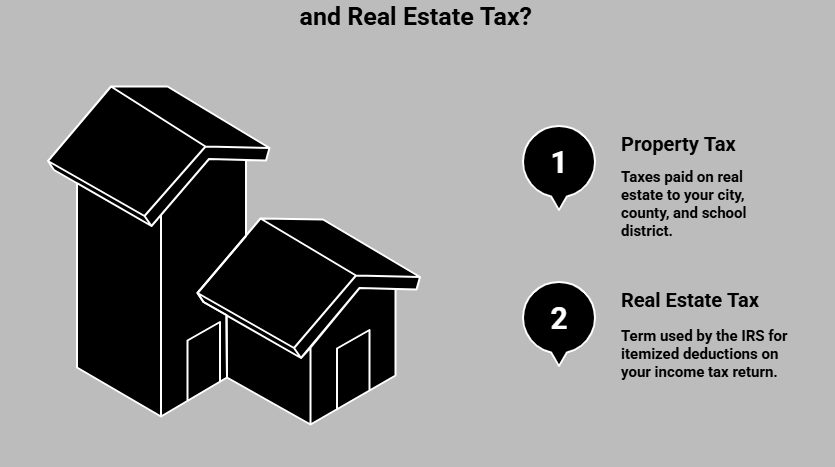

Here’s the difference in how they’re sometimes used:

- Property Tax: Common term for taxes you pay on real estate to your city, county, and school district.

- Real Estate Tax: Often appears in federal tax documents and is used by the IRS for itemized deductions on your income tax return.

So while there’s no practical difference in most Houston homeowners’ day-to-day lives, it’s still helpful to understand why both terms exist, especially if you’re filing taxes or reading official documents.

What Does Your Property Tax Actually Pay For in Houston?

If you’ve ever looked at your mortgage escrow breakdown or gotten your tax bill from Harris or Fort Bend County, you know this isn’t a small number. In fact, Texas has some of the highest property tax rates in the country.

In Houston, property taxes go toward:

- Local public schools (a big chunk of it)

- County and city services like roads, police, and fire departments

- Flood control and utility infrastructure

- Public hospitals and libraries

Even if you don’t have kids in school or rarely use public facilities, you’re still paying for the community you live in. That’s why your Houston neighborhood’s tax rate matters and varies.

Are There Different Types of Property Taxes?

This is where the terminology can get fuzzy.

While real estate tax or property tax typically means taxes on land and buildings, there are also personal property taxes in some states. These apply to things like vehicles, boats, and business equipment.

But in Texas? You only pay real estate/property taxes on real estate, not personal items. That’s one area where it’s simpler.

So, when you’re budgeting for your Houston dream home, know that you have to just pay one kind of tax, the annual tax based on your home’s assessed value.

How Is Property Tax Calculated in Houston?

Your annual property tax bill depends on two things:

- Your home’s assessed value (not the market value, but what the county appraisal district says it’s worth)

- The combined tax rate from your city, county, school district, and any special districts

For example, if you’re in Katy ISD, your rate might be higher than someone living in the Houston ISD zone, even if the home prices are similar.

That’s why working with a local real estate agent matters. At KV Properties, we always walk buyers through not just the home price, but the ongoing cost of living in that neighborhood, including tax rates, exemptions, and long-term affordability.

Can You Reduce Your Property Tax in Texas?

Yes, it is possible to reduce property taxes in Texas, and you should try if you’re eligible.

Here’s what to look into:

- Homestead Exemption: If you live in the home, you can knock thousands off the taxable value.

- Senior or Disability Exemptions: Available if you’re over 65 or meet eligibility criteria.

- Protest your appraisal: Every spring, you can challenge the county’s assessment if it seems too high.

These savings don’t happen automatically; you need to file. And they can make a big difference over the years.

Final Thoughts

So, to sum it up, yes, property tax and real estate tax are basically the same. In Houston and across Texas, they refer to the same annual tax homeowners pay based on property value.

But knowing how these taxes work and how to navigate them is a key part of buying or owning real estate in Houston.

At KV Properties, we help you go beyond the listing price. Because the true cost of homeownership isn’t just in the mortgage, it’s in what you’ll owe year after year. And we make sure you’re never caught off guard. Contact us today if you are planning to buy a property in Houston and/or are stuck with making the next move.

Frequently Asked Questions

What Do Property Taxes Pay for in Houston?

Your property taxes help fund public schools, police, fire departments, roads, libraries, and other local services across the city and county.

How Is Property Tax Calculated in Houston, Texas?

The county sets a value for your home, then applies local tax rates from the city, school district, and other agencies to calculate your bill.

How many years can you go without paying property taxes in Texas?

You typically have up to one year before foreclosure begins, but penalties and interest start right after the January 31st deadline.

Can You Lower Your Property Tax Bill in Houston?

Yes, if your home is your primary residence, you can file for a homestead exemption. Seniors and disabled homeowners get additional savings.

How Do You Dispute a Property Tax Appraisal in Houston?

You can protest through the appraisal district if you think your home is overvalued. It usually involves submitting proof and attending a hearing.

Karishma Naidu Vohra is a dedicated real estate agent renowned for her entrepreneurial spirit and commitment to excellence. After developing her skills in Los Angeles, she found her true passion in Houston, where she specializes in buying, renting, and selling properties.