How to Improve Your Credit Score for a Home Loan?

Thinking of buying a home soon? Then your credit score deserves your attention, because lenders don’t just look at how much you earn, but how you manage your money. Even a 20-point improvement can shift your loan terms more than you’d expect.

The good news? You don’t need to be a finance expert to improve your score. But you do need to be consistent, strategic, and clear about what actually moves the needle.

Firstly: Know Where You Stand (And Why It Matters)

Your credit score isn’t just a number; it’s your financial credibility. It tells lenders how likely you are to pay them back on time. The higher the score, the more trust they have in you.

Here’s how scores typically break down:

- 760 and above = Excellent (best rates, lowest fees)

- 700–759 = Good (solid approval odds)

- 620–699 = Fair (you’ll qualify, but may pay more)

- Below 620 = Needs work (may delay approval or increase down payment)

Knowing your category gives you a starting point and a target, of course!

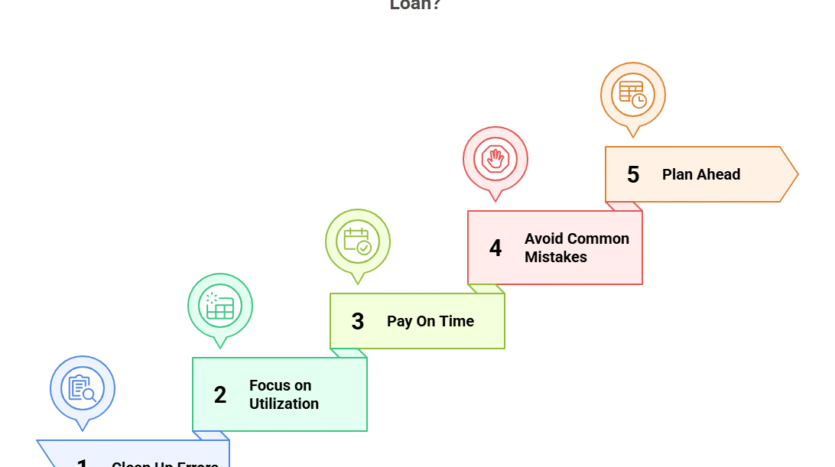

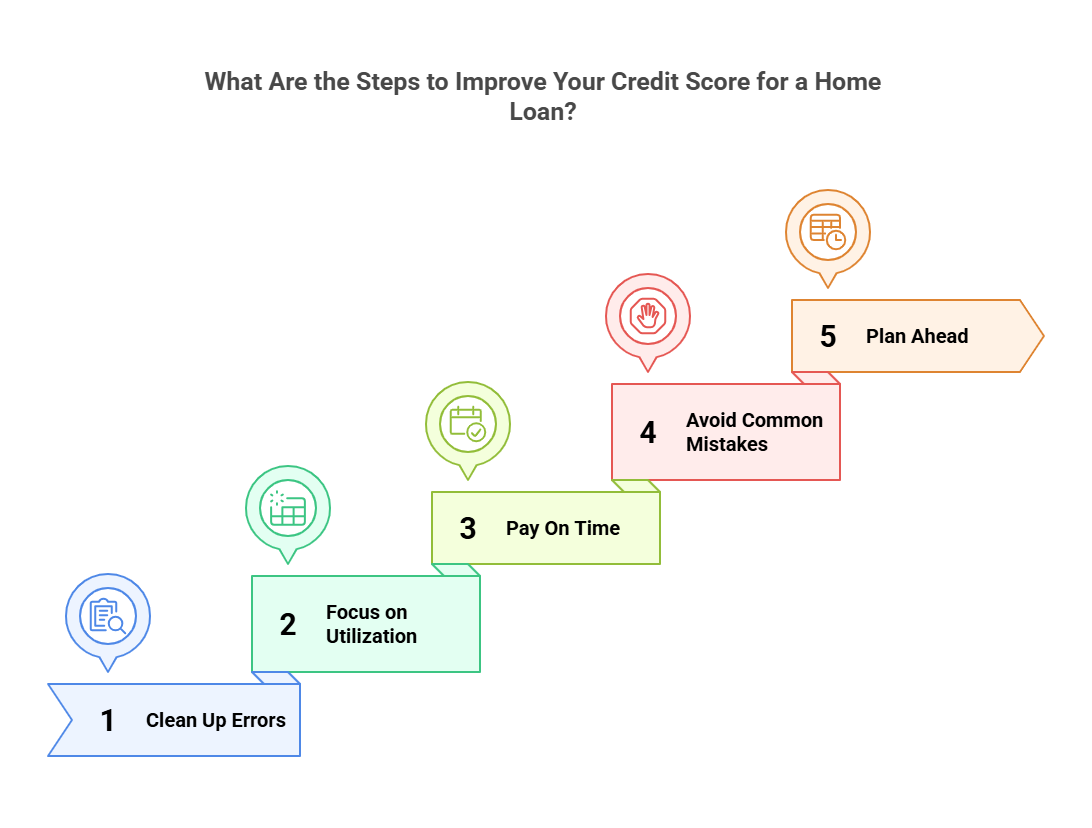

What Are the Steps to Improve Your Credit Score for a Home Loan?

Now that you know the score needed for approval, let us provide you with a few solid steps that can improve your credit score for your dream home.

Step 1: Clean Up Errors That Are Holding You Back

Start with your credit report, not your score. A report tells the full story, including missed payments, duplicate accounts, and past debts.

What to do:

- Visit AnnualCreditReport.com to download your report from all three bureaus

- Look for incorrect addresses, accounts you didn’t open, or outdated balances

- Dispute anything that doesn’t look right; errors are more common than you think

A clean, updated report can quickly add points back to your score without paying off a single dollar.

Step 2: Focus on Utilization, Not Just Payments

Paying your bills on time? Great, but if you’re constantly using up most of your credit limit, lenders still see red flags.

High utilization makes it look like you’re depending on credit to stay afloat, and that can drag your score down fast.

Want to flip that script?

Keep your usage under 30%. Pay down balances, ask for a credit limit bump (and don’t touch it), and avoid maxing out cards, even temporarily. Low usage isn’t just smart. It’s a green light for lenders, especially when you consider investing in the Houston real estate.

Step 3: Pay What You Owe, and Pay It Right

Timely payments are the single biggest factor affecting your credit. One missed bill? It can stay on your record for seven years.

Make this your routine:

- Set calendar reminders or automate payments for at least the minimum amount

- Prioritize loans or cards with the highest interest; that’s where late payments hurt most

- If you’re behind, call the lender; some offer one-time forgiveness to avoid reporting a late payment

Remember that consistency here has the biggest long-term payoff.

Step 4: Don’t Make the Common Mistakes

Just because you’re planning ahead doesn’t mean every move is the right one. Opening multiple new credit cards to “build credit”? It might backfire. Closing old accounts that still have a credit line? That can shorten your credit history and raise your utilization rate.

Even co-signing a loan can be risky; one missed payment from the other person, and your score takes the hit.

Lenders are watching more than your number. They’re looking at your entire credit behavior, how long you’ve had accounts, how you use them, and how stable your financial footprint appears.

Every unnecessary new account or account closure can change your credit age, credit mix, and perceived risk, and not in your favor. Before you take any action, ask: Will this make me look like a better borrower?

Step 5: Start Planning Months Before You Apply

Improving your credit score isn’t about last-minute moves. It’s a process that takes time, so start early. Six months before you plan to apply for a mortgage, pull your credit reports, scan for any errors, and file disputes if needed.

Fixing just one wrong entry or small balance can give your score a solid bump, but it needs time to reflect.

From that point on, avoid applying for new credit, don’t rack up large purchases, and stay consistent with your payments. If you’re not sure what credit score will get you the best rates, speak to a mortgage advisor early.

A quick review could show you how close you already are or help you map out how to get there. Small moves now can save you thousands later.

How Long Does It Take for Credit Improvements to Reflect?

The steps are clear now, but learning how long it will take for credit improvements to reflect is another factor to consider.

Most credit score changes don’t appear overnight. Even if you pay down debt or fix an error, expect a 30–60 day delay before your score updates. That’s how long credit bureaus typically take to reflect new data.

But lenders don’t just want to see a higher score; they want proof it will last. A few months of consistent behavior show stability. No new debt, on-time payments, and steady credit use over 3–6 months build the confidence lenders look for.

So if you’re serious about buying, start early. Don’t rush the results; let them stack up.

Final Thoughts

Your credit score can open doors or slow you down. But it’s not fixed, and improving it isn’t guesswork. With the right steps and a little patience, you can position yourself for better approval odds and lower costs.

At KV Properties, we help buyers not just find the perfect home, but also get financially ready for it. If you’re planning to buy soon and want expert guidance on both homes and home loans, we’re here to help with real steps that get you closer to the keys.

Let’s connect now and buy that perfect home you’ve always wanted in H-Town!

Frequently Asked Questions

1. What credit score do I need to buy a home?

Most lenders prefer a minimum score of 620, but scores above 700 can get you better interest rates and loan terms.

2. How quickly can I improve my credit score?

With focused action like paying down balances or fixing errors, you may see noticeable improvement within 30 to 90 days.

3. Will checking my own credit score lower it?

No, checking your own score is a soft inquiry. It doesn’t impact your credit and is recommended for regular monitoring.

4. Does paying off a loan help my credit score?

Yes, especially if it reduces overall debt and improves your credit utilization, payment history, and debt-to-income ratio.

5. Should I close old credit cards before applying for a mortgage?

Not unless necessary. Keeping old cards open maintains your credit history length and lowers your credit utilization percentage.

Karishma Naidu Vohra is a dedicated real estate agent renowned for her entrepreneurial spirit and commitment to excellence. After developing her skills in Los Angeles, she found her true passion in Houston, where she specializes in buying, renting, and selling properties.