What Is a Short Sale in Real Estate?

A short sale in real estate is when a home is sold for less than what’s owed on the mortgage, with the lender’s approval. It’s typically used when the homeowner is struggling financially and wants to avoid foreclosure.

Now, if you’re buying or selling in Houston and come across the term “short sale,” don’t brush it off. This isn’t a loophole or a rare case; it’s a real option, especially in unpredictable markets.

For sellers, it’s a way to exit a tough financial situation with less credit damage. For buyers, it might be a chance to get a deal, but not without patience and paperwork.

In this blog, we’re breaking down how short sales work, who they’re right for, and what buyers and sellers should know before stepping in. Let’s quickly get into it.

Why Homeowners Choose a Short Sale?

Life happens.

People lose jobs. Incomes drop. Home values don’t always rise like we expect. Sometimes, even if you’ve been doing your best, your mortgage becomes more than your home is worth.

When that happens, selling the home in Houston can feel impossible. But a short sale offers a way out that’s far better than foreclosure.

Here’s what short sale offers:

- It gives homeowners some control over the process; you’re not just waiting for the bank to show up and take over.

- It softens the credit hit, so you’re not locked out of buying again for a decade.

- And most of all, it gives people breathing room to move forward with dignity and without being forced out by a sheriff’s notice.

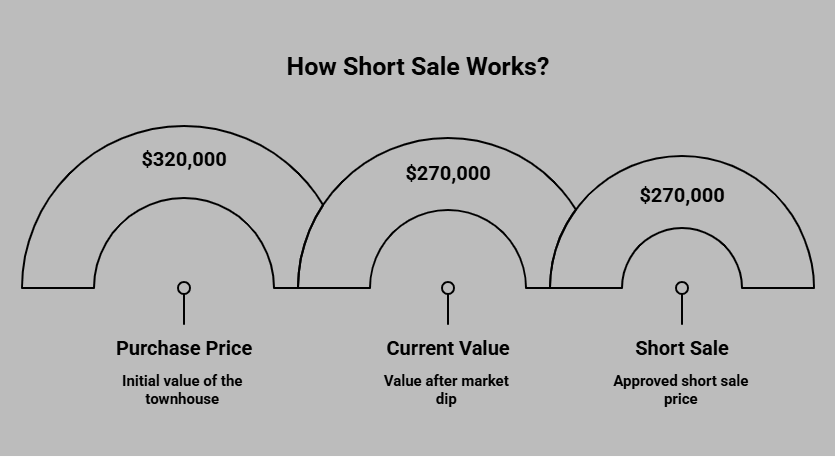

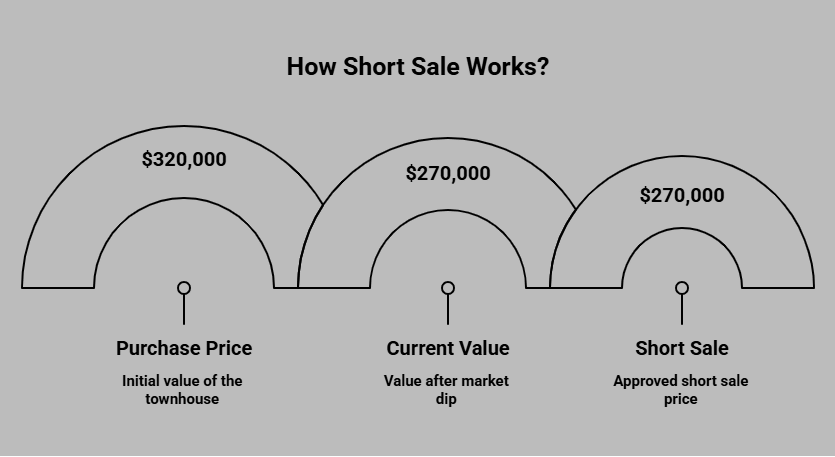

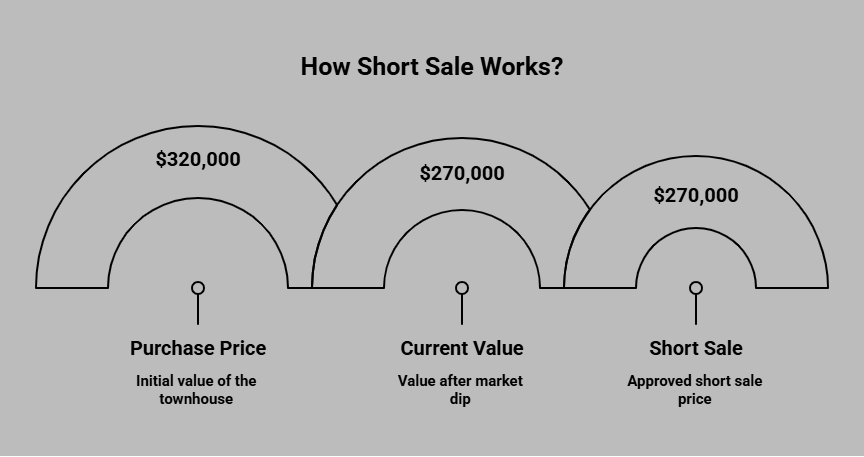

How a Short Sale Works?

Think of it as a three-party deal: seller, lender, and buyer, all trying to find a middle ground.

- First, the homeowner has to prove hardship; this isn’t about walking away from a home on a whim.

- A realtor then lists the property as a short sale, and every offer must go through the lender.

- Once offers come in, the lender decides if the numbers make sense, and this is where patience comes in.

For example, a homeowner in Houston bought a townhouse in 2021 for $320,000. Two years later, due to a dip in the market and unexpected repairs, the home’s value dropped to $270,000. They still owed $295,000 on their mortgage.

Instead of facing foreclosure, they worked with a real estate agency to request a short sale. The lender reviewed their financial hardship and approved the sale at $270,000, forgiving the $25,000 difference.

- If approved, you close. If not, you’re either back to square one or worse, headed toward foreclosure.

The process isn’t fast. But for many sellers, it’s a way to walk away without wrecking their financial future. And for buyers? It’s an opportunity if you’re willing to wait.

What Buyers Need to Know?

Short sales can be gold or a grind. If you’re someone who wants quick closings or doesn’t like surprises, this might not be your thing.

But if you’re patient, open-minded, and working with a real estate agency that knows how to handle the paperwork, there are wins here:

- You’ll likely pay less than you would in a traditional sale.

- There’s less buyer competition because not everyone wants to deal with delays.

- You still get a chance to inspect the home, unlike many foreclosures.

That said, be prepared:

- Things move slowly. Lenders don’t rush for anyone.

- The home is sold as-is, no repairs, no upgrades.

- There may be multiple approvals needed from lien holders, second mortgages, or even HOAs.

- And sometimes, even after all that, your offer might not get accepted.

The key is to go in knowing this isn’t a typical transaction, and to have the right team backing you.

What’s the Difference Between Short Sale vs. Foreclosure?

Let’s keep it real. No one wants to go through either. But if you’re in a tough spot, a short sale is the more manageable of the two.

| Feature | Short Sale | Foreclosure |

| Who initiates | Homeowner asks for lender permission | Lender files to take back property |

| Credit impact | Modest; 50–100 points | Severe; up to 300+ points |

| Process control | Seller stays involved | The bank seizes control |

| Long-term loan eligibility | May requalify in 2–4 years | Typically, 5+ years before eligible |

The main difference? A short sale is you saying, “Let’s fix this before it gets worse.” Foreclosure is when it’s already too far gone.

Why Realtors and Real Estate Agencies Matter?

You can’t do this alone, and you shouldn’t have to.

Short sales come with serious paperwork, lender approvals, timelines, and legal considerations. This is where having a seasoned realtor makes all the difference. Not someone who’s “done one or two”, someone who knows this inside out.

At KV Properties, we don’t just list and wait. We anticipate. We talk to lenders, move files forward, and explain every step to buyers and sellers so no one feels stuck in limbo.

A short sale is only smart if it’s managed well. That starts with choosing the right real estate agency to back you.

Is a Short Sale Right for You?

This isn’t a decision to rush. If you’re a seller barely staying afloat or a buyer hoping for a deal, a short sale might be worth exploring, but only if you’re realistic about the process.

You’ll need guidance, patience, and an experienced team to help navigate the mess that lenders often make. But if done right, it’s a move that protects your future.

If you’re unsure what direction to take, don’t just Google your way through it. Let’s have a real conversation because the right move starts with knowing all your options.

Frequently Asked Questions

1. Is a short sale the same as foreclosure?

Not at all. A short sale is voluntary and negotiated. Foreclosure is forced and far more damaging.

2. How long does a short sale take?

On average, 4–6 months, but it depends on how responsive the lender is and how clean the paperwork is.

3. Will the seller owe money after a short sale?

Sometimes. Some lenders forgive the remaining balance; others may want a partial repayment or a promissory note.

4. Can I get financing for a short sale?

Yes, as long as your lender is flexible and you’re preapproved. Some banks even prefer cash or conventional loans.

5. Are short-sale homes a good deal?

If you know what you’re doing and have time to wait, yes. But don’t expect move-in-ready. These are often fixer-uppers.

6. How does a short sale affect my credit?

Better than foreclosure. You’ll still take a hit, but it’s lighter and more recoverable, usually within a few years.

Karishma Naidu Vohra is a dedicated real estate agent renowned for her entrepreneurial spirit and commitment to excellence. After developing her skills in Los Angeles, she found her true passion in Houston, where she specializes in buying, renting, and selling properties.